Financial Planning for MedSales Pros—All On One Page

Finally see your entire financial life on one page.

As a MedSales professional, your time is limited and your finances are complex.

Your Family CFO turns all that complexity into clarity — fast. With your Asset-Map®, you’ll see your entire financial life on one page and know exactly what to do next — no spreadsheets, no back-and-forth, no guessing.

Why MedSales Pros Need Different Planning

Why traditional financial planning doesn’t work for MedSales.

Most financial plans are built for people with steady paychecks and predictable careers. That’s not you. As a medical sales professional, your income spikes, your comp plan changes, and your time is limited. If your advisor doesn’t understand that, your plan will always feel out of sync with reality.

-

You’re earning great money, but it doesn’t feel like long-term wealth

-

Big bonuses and commissions hit your account… then disappear into life

-

Taxes feel like a black box, and you suspect you’re overpaying

-

You don’t have a clear Walk-Away Number or freedom timeline — just “keep grinding”

That’s why our planning process is built specifically for MedSales — and powered by Asset-Map® so you can see everything clearly on one page.

Your Financial Command Center

Instead of drowning in portals and 40-page PDFs, we start with a single visual: your Asset-Map®. It’s your financial command center — showing your income, accounts, equity comp, insurance, goals, and priorities on one simple page.

Instant Clarity

See your cash, investments, stock, debt, insurance, and goals mapped visually so you know exactly where you stand.

Priority Based Planning

We highlight the top 3–5 priorities that will move the needle most for your Walk-Away Wealth — not 97 random to-dos.

Faster, Better Decisions

Every strategy we discuss — Roth conversions, bonus deployment, payoff vs investing — is tied back to your Asset-Map® so decisions feel clear and grounded.

Meet the Future of Financial Advice

We believe traditional financial advisors charge too much and offer too little. That's why we built a membership model that provides more value at a lower cost. Our month-to-month structure and quarterly reviews ensure we stay focused on your evolving needs. It’s time for financial planning that puts you first. Schedule a meeting and experience advice tailored to you.

What you get with a Personal membership

A comprehensive financial plan that aligns your values and your money

Quarterly meetings to keep you on track and your plan current

Unlimited investments

Tax planning and projections

Risk mitigation strategies to protect your wealth and your family

What you get with a Personal membership

No commissions, hidden fees or kickbacks

We don’t require you to move your money

No high-pressure sales, we are here to help.

No risk or style buckets. Investments personalized to your plan.

Pulse Strategic Planning System

How our financial planning process works.

We keep things simple, structured, and respectful of your schedule. Most MedSales pros don’t need more homework — they need a clear process and someone to own it with them.

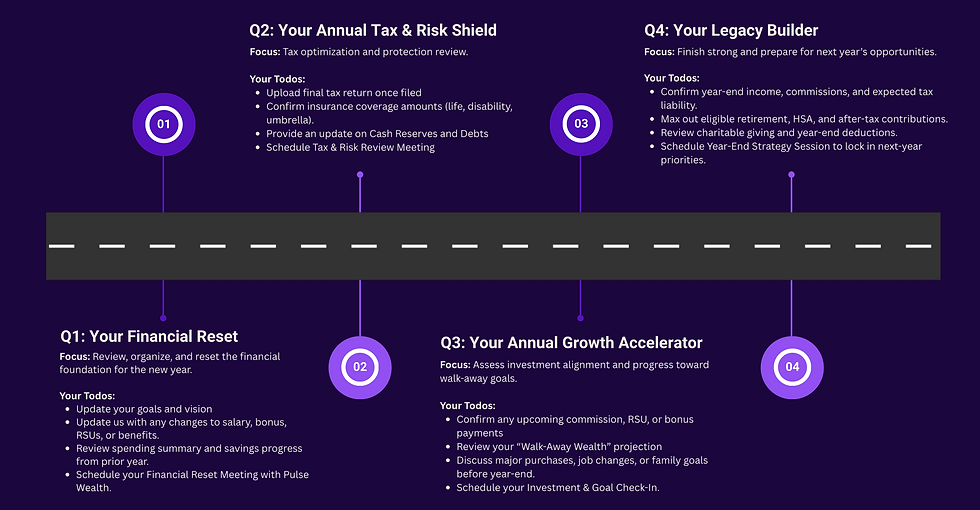

Our quarterly focus map outlines key planning conversations and helps our clients efficiently and effectively navigate the strategic planning process.

Meet the Future of Financial Advice

We believe traditional financial advisors charge too much and offer too little. That's why we built a membership model that provides more value at a lower cost of $550/month per household. Our month-to-month structure and quarterly reviews ensure we stay focused on your evolving needs. It’s time for financial planning that puts you first. Schedule a meeting and experience advice tailored to you.

What you get with a Personal membership

A comprehensive financial plan that aligns your values and your money

Quarterly meetings to keep you on track and your plan current

Unlimited investment management, one flat fee

Tax planning and projections

Risk mitigation strategies to protect your wealth and your family

Free Will and Estate Plan

Our promise to you

No commissions, hidden fees or kickbacks

We don’t require you to move your money

No high-pressure sales, we are here to help.

No risk or style buckets. Investments personalized to your plan.

Ready to see your Walk-Away Wealth on One Page?

If you’re a MedSales professional who’s tired of feeling like your money is scattered and your future is vague, it’s time for a different approach. With Asset-Map® and a MedSales-specific planning process, we’ll help you turn today’s income into tomorrow’s freedom.